Virtual Branch Online Banking

- Easily enroll online

- Set up a payment schedule for your loans and credit cards

- Set up Alerts for account status

- Set up BillPay service

- Set up person-to-person payments (Zelle®) through BillPay

Helpful hints when using Virtual Branch:

- Virtual Branch allows you to link all of your accounts together under one logon id. Just call PCMCU and ask for the “link your accounts together” option, and we’ll be happy to set you up with this added convenience!

- When you’re enrolling in Virtual Branch, the Member Number is your account number and the Security Code is considered your password.

- You may reset your own security code by clicking ‘Forgot Security Code’ when entering your Logon ID.

- Enroll in eStatements today for both your personal and credit card statements. It’s safe, secure and convenient.

- Don’t forget to sign up for PCMCU’s Mobile App for your smart phone. You may also set up account alerts under the “Self Service” tab to receive designated balance alerts via email and text.

Follow these simple steps to Nickname your accounts:

- Log into your Virtual Branch Online Banking

- Click on settings

- Click on accounts

- Click on account preferences

- Click on edit behind the account you would like to Nickname

- Enter nickname and click save

- A message will display that your account preferences have been successfully updated

Please Note:

In some situations, if you have an older cell phone, tablet, desktop or laptop you may no longer be receiving updates from the operating system provider such as Microsoft, Apple or Samsung/Android. Once these companies stop updating your devices our online banking system/Mobile App will no longer work due to not having proper security to protect your personal financial information.

QUESTIONS? If you have questions or concerns regarding PCMCU’s Virtual Branch and eServices, please feel free to contact us, or call (920) 499-2831 for more information. We are always happy to serve you!

Mobile App

PCM Credit Union’s Mobile App with Mobile Deposit Capture is available for download on the App Store or Play Store!

Enjoy the convenience of:

- Checking Balances

- Now even faster with instant balance capabilities!

- Transferring funds

- Making mobile deposits

- Viewing your deposit check history

- Paying Bills

- Managing scheduled payments

- Sending and receiving money to/from other people

- Locating ATMs

- And having quick access to PCMCU locations, hours, rates, specials events, and more!

Please Note:

In some situations, if you have an older cell phone, tablet, desktop or laptop you may no longer be receiving updates from the operating system provider such as Microsoft, Apple or Samsung/Android. Once these companies stop updating your devices PCM’s online banking system/Mobile App will no longer work due to the older operating system not having proper security to protect your personal financial information.

QUESTIONS? If you have questions or concerns regarding PCMCU’s Mobile App, please feel free to contact us, or call (920) 499-2831 for more information. We are always happy to serve you!

Zelle®

Learn More About Zelle®

With Zelle, it’s easy to send – and receive – money.

With these great features, you have a lot to look forward to. When you send money with Zelle, you always know where your money is because it moves directly from your account to theirs, typically in minutes.1

| Fast Money is sent from your account into theirs typically in minutes.1 |

Safe With the security you already know and trust from PCM Credit Union. |

Easy Send money to almost anyone you know and trust using only their email address or U.S. mobile phone number.2 |

Watch this 1-minute Zelle Overview Video Now!

Mobile Deposit Capture

To make sure your checks get accepted for deposit, please follow these tips for taking clear, high quality check photos:

- Sign the back of your check AND endorse it “PCMCU Mobile Deposit” directly below your signature.

- When prompted for the amount, carefully enter the check amount to ensure it matches the amount written on your check.

- Keep the check within the corner marks on the camera screen when capturing your photos.

- Take the photos of your check in a well-lit area.

- Place the check on solid dark background before taking the photo.

- Keep your smartphone or tablet level and steady above the check when taking your photos.

- Make sure that the entire check image is visible and in focus before submitting it for deposit.

- Make sure the MICR line is readable. (numbers on the bottom of your check)

Following these tips should make for a successful mobile deposit!

Mobile Deposit Capture Processing Information:

- When we receive your mobile deposit, the images will be viewed for acceptability.

- If you’ve made a mobile deposit BEFORE 2:00pm CST on a regularly scheduled business day (M-F), items will generally be posted to your account after 3:00pm CST of that same day.

- If you’ve made a mobile deposit AFTER 2:00pm CST on a regularly scheduled business day, or on Saturdays, Sundays, or Federal holidays, items will generally post to your account on the next business day, after 3:00pm CST

Mobile Deposit Capture Limitations:

- The largest deposit allowed on a single business day is $3,000.

- The daily guideline also includes a per item deposit limit of $3,000.

- Checks are limited to be deposited into Share Draft/Checking Accounts

- Check holds may apply.

Digital Wallet

Samsung Pay™, Apple Pay™, and Google Pay™ are ALL available at PCMCU!

Enjoy this convenient and secure way to pay using your smartphone or smartwatch.

Upload all of your PCMCU cards into your mobile wallet and begin using this contactless form of payment. After loading your cards and authorization of your cards has been made, you may then make purchases just by swiping your device in the vicinity of the cashier’s kiosk.

Your card information is never shared when paying with these mobile payment options, making it a safer way to pay!

Cards

Manage your Cards with the PCM Mobile App:

Card management and spend tracking functionality will now be available from a single app – the same app you use for mobile banking.

Designed to optimize your experience, the new features will be found by tapping “Cards” right inside PCM’s Mobile App. You’ll still have all the features you’re used to in the CardValet app, and more, including:

![]() • Transaction notifications

• Transaction notifications

• Enriched transactions to clearly see where your purchases are made

• Recurring payment visibility for subscriptions and cards on file with merchants

• Controls and alerts for location, merchant type, and spending limit preferences

• Simplified reporting of lost or stolen cards

• Track spending by month, category and more

What Should I Do to Get Ready?

- If you haven’t already, download PCMCU’s Mobile App (see download links below), set up an account and login to become familiar with the app.

- Turn on automatic app updates on your phone so you get the new features as soon as they are rolled out.

- Enable push notifications in PCM’s Mobile App so you know exactly what to expect and when.

Still Have Questions?

Check out the Card Management FAQ

Contact Us

For any questions regarding the update, please call us at (920) 499-2831.

eStatements

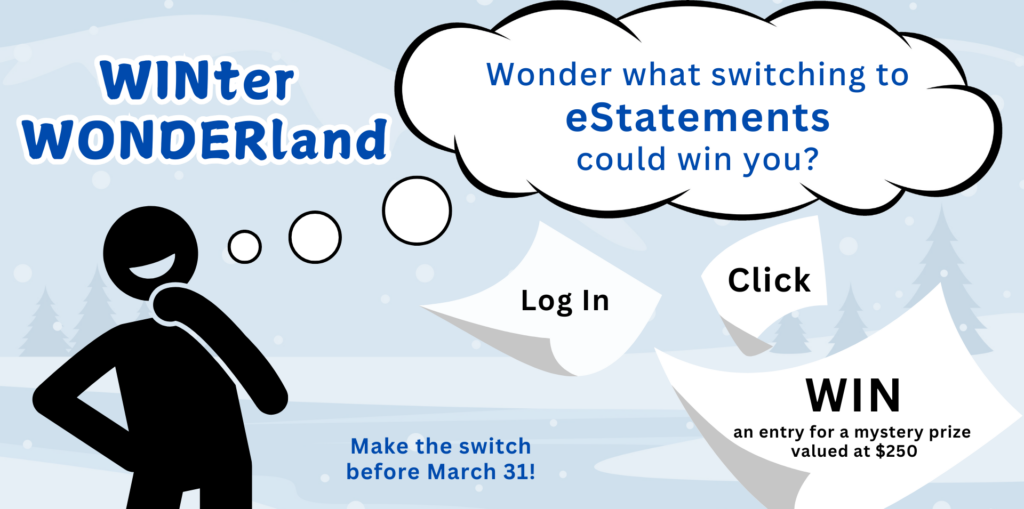

Wonder how you can turn this winter into a WINter? Switch to eStatements before March 31 and be entered to win a $250 mystery prize!

Switching to eStatements is quick and easy through online banking or our mobile app.

How to Switch in the Mobile App:

- Log in to PCMCU Mobile

- Click on ‘More’

- Click on ‘Statements and Documents’

- Follow the prompts

How to Switch Online:

- Log in to Online Banking

- Click on ‘eStatements’

- Follow the prompts

After you enroll for eStatements, you’ll be automatically entered to win. It’s that easy!

Official Rules

Campaign Period 2/3/2025-3/31/2025

Prize Value $250. Individuals may be entered by enrolling in eStatements. One entry per primary member. Entrants must be 18 or older to qualify and must show proof of age upon winning. Employees, Directors, and their families are not eligible to win. Other participants may complete an entry in person at any PCM Credit Union location or by phone with a PCM Credit Union representative. The entry must include a complete name, phone number, and email address. All entry cards become the property of PCM Credit Union once submitted and will not be acknowledged or returned.

One winner will be chosen by random selection and notified by 4/18/2025. Winner will have the choice of one of three prizes valued at $250, which will not be revealed until winner is contacted. Winner must respond by midnight of 4/23/2025 or another winner will be selected. Odds of winning depend entirely on the number of entries. Membership eligibility required. All accounts subject to approval. Federally insured by the NCUA. No purchase necessary. If you have questions regarding this giveaway, please contact PCMCU at (920) 499-2831.